Recurring billing has gained a lot of traction in digital marketing over the past few years, with more online services and products introducing recurring billing via subscriptions. The so-called subscription economy is seeing businesses in all industries introducing some type of subscription service.

Take Kindle, for example. Where you used to buy books for your Kindle via a once-off payment, you now have the option of subscribing to Kindle Unlimited, a monthly subscription that lets you read as many books as you want.

A subscription like this is a type of recurring payment that needs to be managed by the service (Kindle or Amazon in this case). Thankfully, there are online services and software to help you with your recurring billing.

The Advantages of Recurring Billing

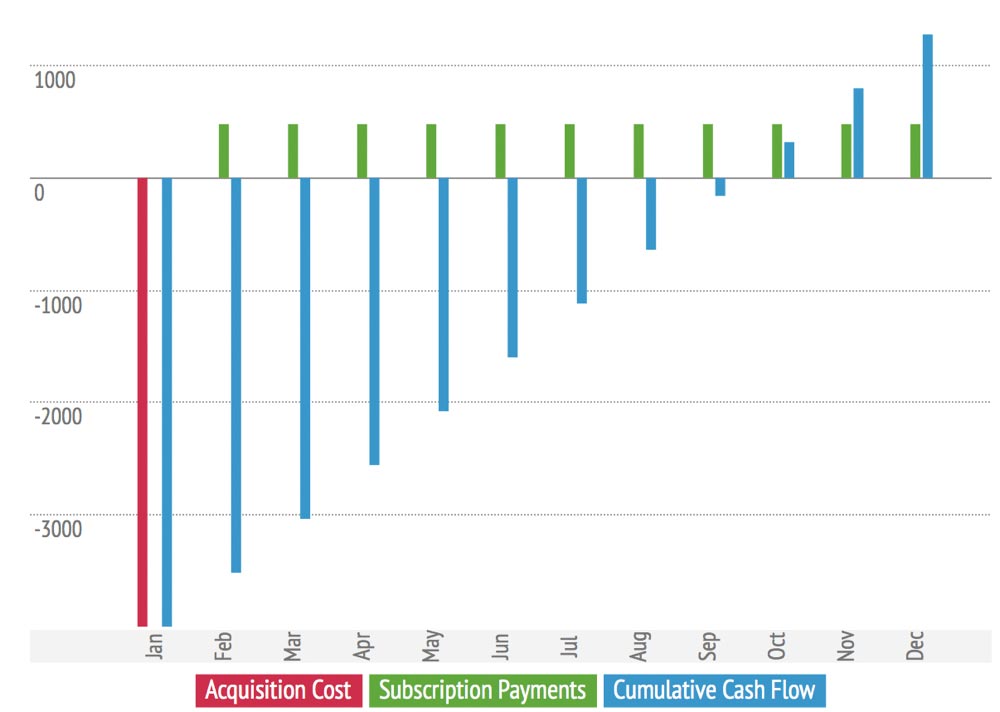

The main advantage of using recurring billing is the constant cash flow. Having subscribers who are automatically billed each month creates a healthy cash flow for your business. You can be sure that these payments will be made as well. No more late or skipped payments when the money is automatically collected.

You also don’t have to send out invoices. Invoicing is automatic with this type of billing system, so you don’t have to allocate as many employee hours to invoicing and collections.

Saasmetrics did a great case study on the clear benefits of recurring billing.

Subscriptions also mean you can nurture ongoing relationships with your customers. There are more opportunities to provide an ongoing quality service and grow your reputation via word of mouth.

Who Benefits the Most

Some types of businesses that offer subscription-based services might come as a surprise. These days, you can even sign up to have beauty products or recipe ingredients delivered to your home for a monthly fee. However, certain types of businesses will always benefit particularly well from having recurring billing in place.

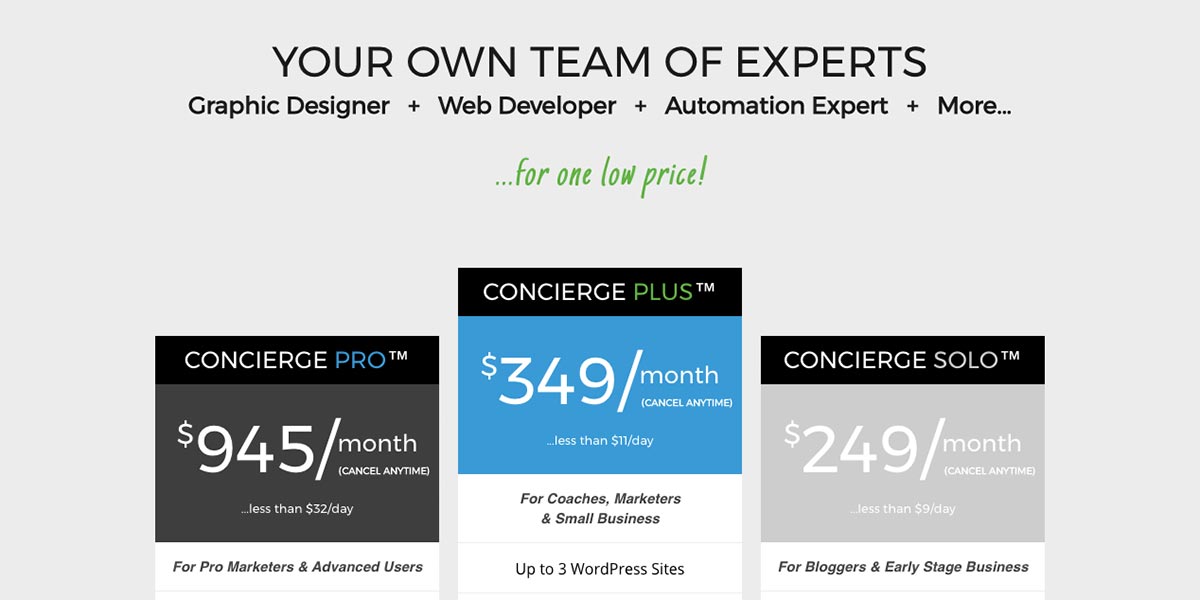

Retainers

These are businesses, like ours, that offer services to clients on a monthly cycle, such as design or marketing services.

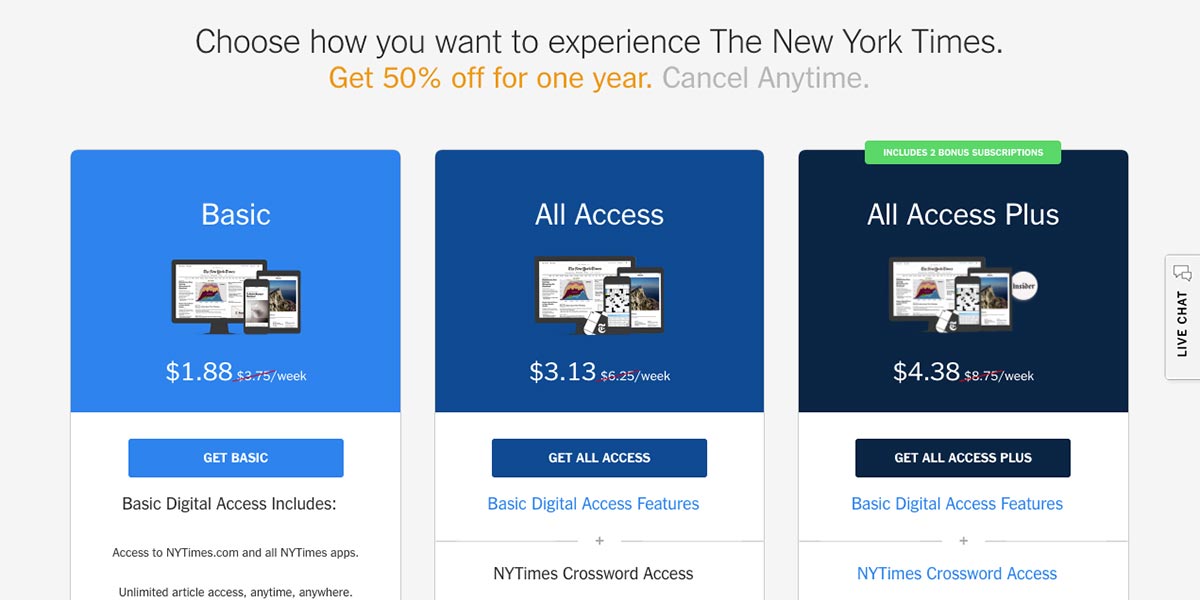

News Sites

As news sites like the New York Times move towards digital, more reputable brands rely on subscriptions to generate income. Some news sites offer memberships for additional content that require a monthly fee. Recurring billing makes sure these memberships don’t lapse.

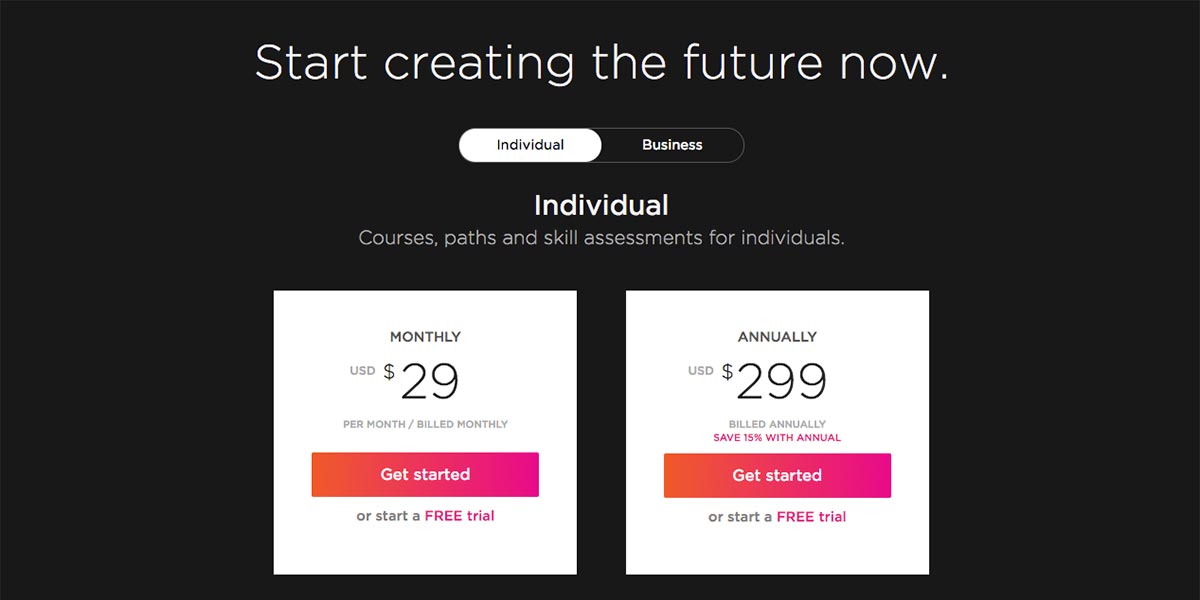

Educational Content

There are lots of educational sites that use a subscription-based business model. Sites such as Lynda offer educational content, like videos lectures and tutorials for a monthly fee.

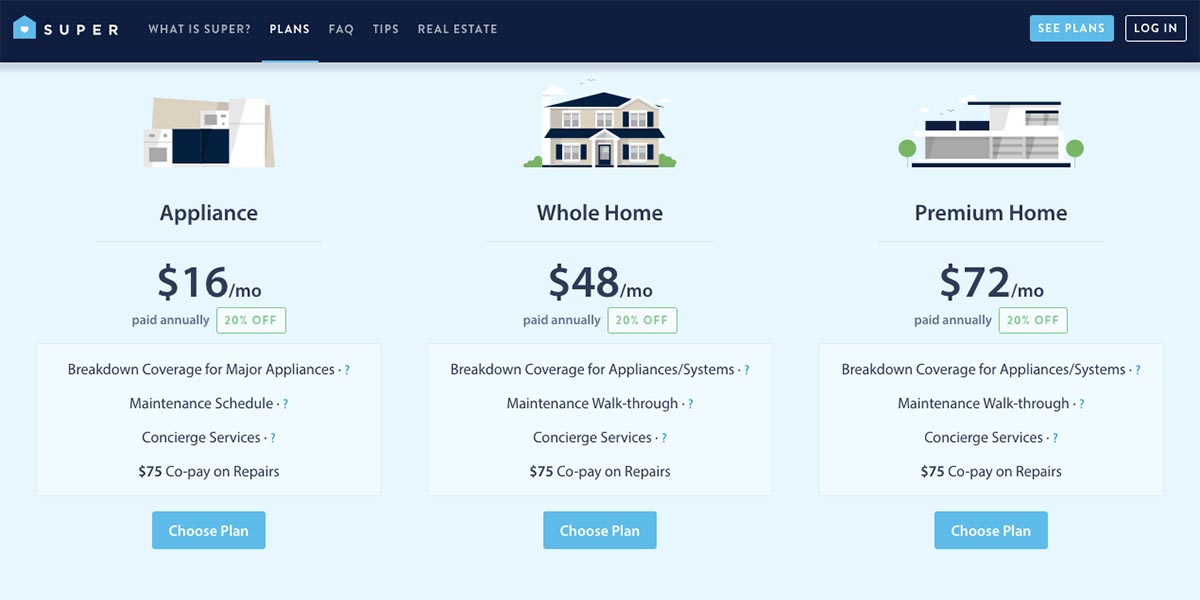

Maintenance Plans

This is an example where an offline service can have their payment system online. Monthly printer maintenance, for example, could be billed using recurring billing. Even home maintenance can be managed via an online subscription.

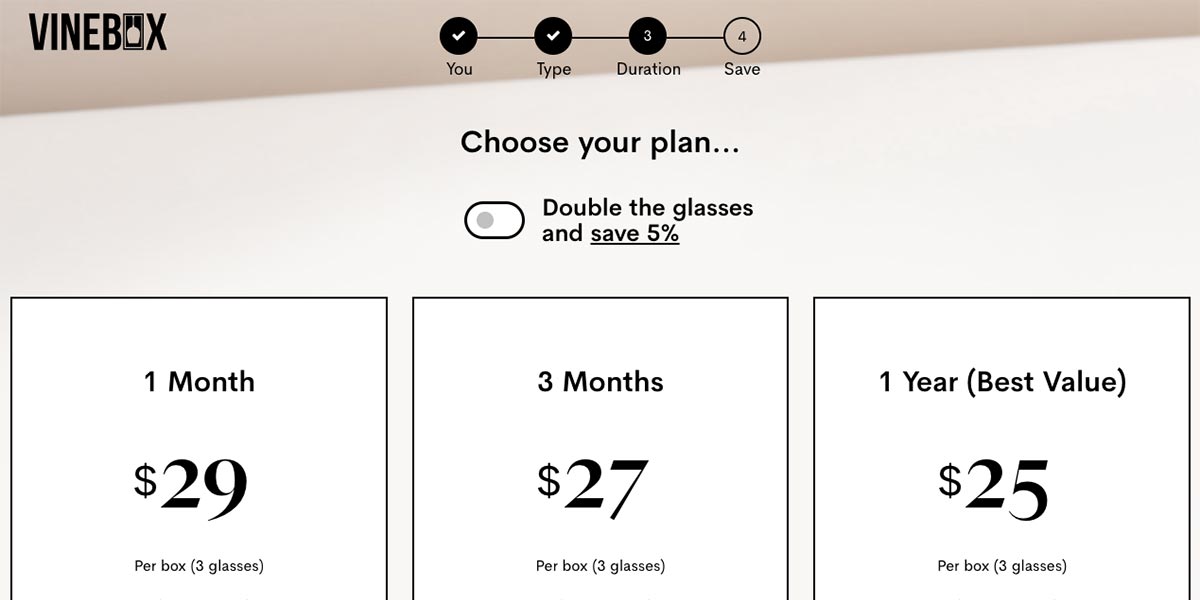

Monthly Goods Delivery

Certain goods, such as wine and cosmetics, do particularly well with a recurring billing business model. Some companies also offer a monthly delivery of items such as organic vegetables or wines that are on special. These subscriptions are easier to manage with recurring billing.

The Best Recurring Payment Platforms

There are quite a few recurring payment systems available, but here are the best recurring billing services for your subscription site.

Infusionsoft

Pros: Infusionsoft is known for its easy-to-use interface, fantastic support, and a marketplace which boasts 300+ third-party apps. It also has a built-in shopping cart/ecommerce that offers order forms, payment processing, and inventory tracking.

Cons: There is a required one-time fee for new user training of $999 and upwards, which is a bit hefty. None of the apps are native, which means third-party apps incur further costs.

Fee: Starting at $99 per month.

Ontraport

Pros: It’s one of the most affordable automation systems with no setup fees and great onboarding support. It has a huge range of ecommerce features that are perfect for recurring billing. They have fantastic support via phone, chat, and email, with a very high customer satisfaction rate.

Cons: The interface is not very visually appealing and doesn’t offer graphs or charts.

Fee: Starting at $79 per month

Stripe

Pros: Stripe is very user-friendly and is fast becoming a rival for more established services like PayPal. The payment system is considered fairer on smaller businesses because it’s based on each transaction rather than a monthly fee.

Cons: If your transaction volumes are very high, the per-transaction billing becomes very expensive compared to a monthly fee. They also don’t have telephonic support.

Fee: 2.9% + $.30 per transaction

Braintree

Pros: Braintree is known for being very secure and has very good customer support. Much like Stripe, it operates with a per-transaction charging system, which is ideal for smaller enterprises. They also offer extensive email and phone support, which is great for a payment system where you can’t afford any down time.

Cons: It still lacks a solution that works with mPOS.

Fee: Starting at 2.9% + $.30 per transaction

eWay

Pros: eWay is an established payment gateway based in Australia. They offer 24/7 support, a pay-as-you-go system, and no setup or recurring fees. They also offer a number of plans for those who already have a merchant account with a bank.

Cons: Only operates in 8 countries so far.

Fees: Starting at 1.9% + AUS$.20 per transaction

Set Up Recurring Billing With Automation Agency

Automation Agency supports all of these recurring billing platforms. Setting up your recurring payments is easy with us and we have years of experience integrating payment systems into WordPress sites.

Get in touch to discuss your recurring billing needs or to learn more about the platforms we support.

![What’s the Best Recurring Billing Service? [Platform Reviews]](https://automationagency.com/wp-content/uploads/2017/10/What___s_the_Best_Recurring_Billing_Service-__Platform_Reviews___1_.png)